MV10 NVIDIA Through a Multi-Factor Lens — What the Data Really Shows

26.12.2025

Monica Veterans

Everyone talks about NVIDIA…

But almost no one understands why it dominates.

This is not about chips. Not about hype. In 8 minutes,

I’ll show you the real structure behind it.

Watch the full analysis.

MV9 India Is Becoming a Key Link inGlobal Supply Chains

14.12.2025

Monica Veterans

Public data shows a simple pattern: Supply chains are re-organizing.Not suddenly, but gradually. And India is becoming one of the places where new capacity is being added.

Let’s explore this quietly step by step without forecasts just by looking at structures already visible

MV8 The US Supply Chain Reset — Public Data, Quiet Shifts, 2025 Update

09.12.2025

Maya Veterans

We examine a quiet shift — one reshaping global trade, manufacturing, and economic security.

Not forecasts. Not recommendations.

Just public data… and long-term signals.”

MV7 India has built one of the most advanced and most inclusive digital infrastructures anywhere in the world

05.12.2025

Monica Veterans

one of the most important transformations of our time. A story that didn’t happen overnight, and didn’t follow a Silicon Valley playbook. Public data shows something remarkable… India has built, layer after layer, one of the most advanced and most inclusive digital infrastructures anywhere in the world.

MV6 Is India building the next global supercycle

28.11.2025

Monica Veterans

Is India building the next global supercycle?

In this episode, we explore public data, and long-term structural trends. No advice. No predictions, just perspective.

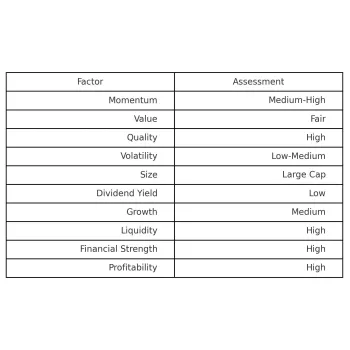

MV5 Multi-Factor Analysis Part 2, HDFC study case

16.11.2025

Edward Veterans

Today we revisit one of the most widely used frameworks in modern investing: multi-factor analysis.

What are the quantitative factors that help explain price behavior?

Many investors describe themselves as stock-pickers or allocators, but a significant part of performance is often linked to factors behind the returns.

The six key factors are: Momentum, Value, Quality, High Dividend, Low Volatility, and Size.

Some of you asked for a study of HDFC Bank, following the earlier episode discussing Michael Porter’s framework.

Today, we use HDFC Bank as an educational example to illustrate how a factor-based perspective works.

MV4 Multi Factor Analysis

09.11.2025

Edward Veterans

Today we explore one of the most powerful frameworks in modern investing — "the multi-factor analysis.”

“What are the quantitative factors that truly drive performance?

Many investors call themselves stock-pickers or allocators, but what really matters…

iis identifying the factors behind returns.

“The six key factors are: Momentum, Value, Quality, High Dividend, Low Volatility, and Size.

“So how can you use this in your own analysis?

Apply these factors to real data, not opinions.”

“And here’s the fun part — we’ll decide together.

In the comments below, tell us which stock, sector, or ETF you’d like us to analyze in a future episode.

We’ll pick one suggestion and walk through a complete factor breakdown.

“That’s how professionals think — with data, collaboration, and transparency.

China 3 "D": Debt, Deflation, Demographics

30.10.2025

Edward Veterans

1) Debt

Official Debt for China represent 88% of the GDP, compared to 121 for the US. But be careful the devil is in the details. 88% is the level contracted by the central state, but it does not take into account the private debt. This private debt is estimated to 192% of the GDP, with a total public + private debt around 300% !

2) Deflation

Chinese economy is very competitive and there are always a lot of plants, factories producing at full speed. The Communist Party gives the guidance for certain sectors, and immediately there are a lot of producers. It happened for solar panels, steel, EV, batteries, each time they are in overcapacity. The overcapacity for the Chinese economy is structural, something to have in mind. As there is too much production, prices fall, as well as profitability.

3) Demographics

A lot of analysts always mention demographics as the Achille heel for China. However we are more measured on this subject. Today Chinese population is 1,4 Bln people, same as India. It should decrease, indeed, but there are ways to compensate : the law on number of children has been changed, workforce is educated and can improve its productivity with AI & robotics.

US China Trade War: What you don't know

30.10.2025

Monica Veterans

Entry of China in WTO in 2002 was decisive for both countries . At that time this was a mutual benefit : United States could buy cheap products coming from China at a low price, while China could strengthen its economic development. It was a win win situation for both. Moreover the Chinese were recycling their proceeds from exportations into Treasury bonds. The United states had also found a way to finance their deficit.

Silently and wisely , China began to reconstitute the « New Silk Road » that existed in the antics, meaning a considerable Chinese power in Asia.

In that extent China has built many infrastructures in Asia, giving considerable amount of money to its neighbors to finance their infrastructure. But it was also a way to increase their dependency to China because China was often lending them the money, sometimes at a high level of interest rates.

Navigating the Growth-Inflation Quadrant: A Strategic Guide

30.10.2025

Maya Veterans

MV13 India Is Not the Next China - A Different Growth Engine

05.02.2026

Monica Veterans

India and China are often compared. Same scale. Similar ambition. But radically different economic engines. In this episode of Money Veterans, we explain why India is not following China’s path — and what that means for investors, supply chains, and long-term growth models.